The decline of the U.S. dollar is increasingly becoming a topic of concern among economists and financial analysts as its once-unquestioned dominance in global markets appears to be waning. In his provocative new book, “Our Dollar, Your Problem,” Kenneth Rogoff reflects on the U.S. dollar’s historical significance and warns of its potential decline in favor of emerging currencies. Factors such as economic sanctions, rising interest rates, and shifting global economic trends compound the challenges to U.S. dollar dominance. As other currencies seek to challenge its supremacy, the implications of this decline for the world economy could be profound. With the dollar’s influence diminishing, observers are left to ponder how this shift might alter international finance and trade dynamics.

As the preeminence of America’s currency falters, an urgent reassessment of its global currency status becomes essential. This unfolding narrative centers on fluctuating economic realities impacting international exchange, monetary policies, and the geopolitical landscape. With figures like Kenneth Rogoff at the forefront of this discourse, there’s significant scrutiny on how the dollar, a longstanding pillar of economic stability, is responding to mounting external pressures. These new developments challenge the historical conventions that have long positioned the U.S. as a leader in global finance. Consequently, the entire fabric of economic interaction could be rewritten as we witness shifts in currency reliance among nations.

The Decline of the U.S. Dollar: An Overview

As the world shifts towards a multipolar economic structure, the dominance of the U.S. dollar appears to be in jeopardy. Kenneth Rogoff’s analysis highlights that the dollar, although still the backbone of global finance, is experiencing a decline in its unique status as other currencies, particularly in Asia, begin to strengthen. This phenomenon is not merely speculative but is supported by significant economic data showing a move towards diversified currency holdings among central banks. The ability of countries to rely less on the dollar means that the advantages previously enjoyed by the U.S. are becoming increasingly challenged.

The implications of this decline are profound. American consumers might find that their financial advantages, such as lower mortgage rates facilitated by dollar supremacy, could evaporate if other currencies gain prominence. Moreover, the U.S. government’s ability to borrow against its massive debt could also diminish, significantly impacting fiscal policies and the economy. Repeatedly, Rogoff emphasizes that we are not at a point where a singular challenger has emerged to overthrow the dollar, but the erosion of its dominance could catalyze more economic volatility.

Global Currency Status: Shifting Dynamics

The global currency landscape is evolving as emerging markets assert their influence. While the U.S. dollar has historically held the dominant position in international trade and finance, new players are vying for a share of this dominance. With countries like China pushing for their currency, the renminbi, to be recognized in international markets, we see a growing desire to challenge long-standing trends. This transition reflects a broader shift towards a multipolar world economy, where multiple currencies coexist without a singular hegemonic power.

Rogoff’s insights suggest that the U.S. must adapt to these changes. The allure of dollar dominance has historically insulated the U.S. from the full repercussions of global economic instability. However, as Rogoff predicts, the erosion of this status may compel the U.S. to re-evaluate its fiscal policies and international relationships. The lessons from history indicate that a decline in currency status can reverberate through economies, impacting trade balances and economic health on a global scale.

Economic Sanctions and Their Impact on Dollar Dominance

The United States has leveraged its dollar dominance through economic sanctions, a tool that has allowed it to maintain influence on the world stage. By imposing sanctions, the U.S. can impact countries significantly, particularly those that challenge its interests. However, Kenneth Rogoff warns that this practice may inadvertently accelerate the move away from dollar reliance. Countries such as China and Russia are actively exploring alternatives to mitigate the effects of U.S. sanctions, equipping themselves with financial strategies that lessen dependency on the dollar.

The use of sanctions, while serving short-term objectives, may contribute to a longer-term decline in U.S. economic power. As nations seek to create independent payment systems and use alternative currencies, they are essentially laying the groundwork for a global financial landscape where the dollar is no longer the default currency. Rogoff suggests that this shift could dilute the effectiveness of sanctions, ultimately eroding the U.S.’s ability to influence global affairs as it once did.

Kenneth Rogoff: Insights from a Veteran Economist

Kenneth Rogoff, a seasoned economist and former chief economist at the International Monetary Fund, offers a unique perspective shaped by decades of experience. His reflections not only recount historical events but also provide prophetic insights into the future of the U.S. dollar and global finance. By intertwining personal anecdotes with economic analysis, Rogoff illustrates how the dynamics of currency dominance are as much a product of policy decisions as they are of economic realities.

Through his latest work, Rogoff does more than analyze the decline of the U.S. dollar; he contextualizes it within the larger narrative of geopolitical changes and economic upheavals. His impressive career, punctuated by interactions with global leaders and firsthand experiences during critical economic periods, lends credibility to his arguments. Ultimately, Rogoff’s insights encourage readers to consider not just the immediate effects of current policies but also the long-term implications for both the U.S. economy and the overall health of the world economy.

The Future of the U.S. Dollar in a Changing Economic Landscape

As we look ahead, the future of the U.S. dollar remains uncertain amidst rapidly changing global economic tides. Rogoff points out that although the dollar is anticipated to retain its status as a primary currency, emerging trends signal that it may lose its exclusivity. Factors such as escalating national debt, trade tensions, and shifts in economic power to Asia threaten to reshape the dollar’s role. The expectation that the currency will continue to thrive without adjustment to new realities is increasingly flawed.

In this volatile environment, stakeholders must brace for potential scenarios where the U.S. dollar does not hold the same weight it once did. Businesses and policymakers alike should consider diversifying their strategies to account for possible fluctuations in currency value and international trade dynamics. The outlook presented by Rogoff serves as a crucial call to action for U.S. leaders to rethink financial practices to sustain economic momentum and adapt to a world where dollar dominance could become a relic of the past.

The Role of Interest Rates in U.S. Dollar Dominance

Interest rates have been a critical factor in the U.S. dollar’s dominance on the world stage. As the Federal Reserve maintains low-interest rates, the dollar has benefited from increased borrowing capacity, making it appealing for international investments. However, Rogoff warns that the current fiscal situation—characterized by rising deficits—may soon force the Federal Reserve to rethink this approach. If interest rates begin to rise significantly, the economic advantages linked to dollar dominance could diminish, affecting its role as a global reserve currency.

Higher interest rates could lead to increased costs of borrowing for both the U.S. government and everyday consumers, which in turn could deter foreign investments. This potential increase in rates, coupled with growing global economic competition, poses a risk to the U.S. dollar’s long-standing supremacy. The balance of maintaining a competitive interest environment while simultaneously managing fiscal health is delicate, and Rogoff’s emphasis on this aspect underscores the importance of sound economic policy in preserving the dollar’s future.

The Historical Context of U.S. Dollar Dominance

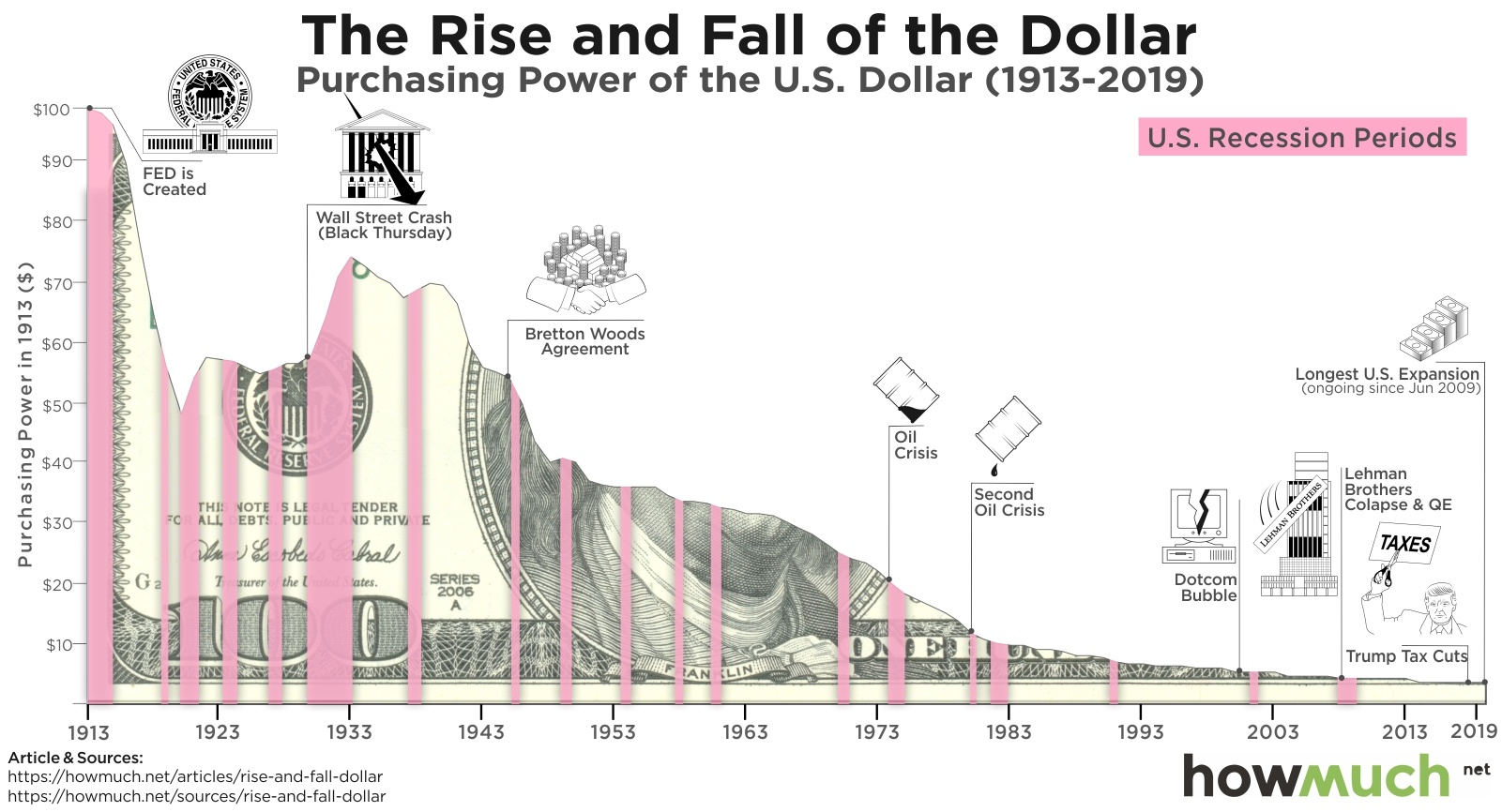

To fully grasp the U.S. dollar’s current standing, it is vital to understand its historical context. The dollar’s prominence began post-World War II, largely due to America’s economic stability and military power. Rogoff’s narrative recounts how the transition from the gold standard to fiat currency in the 1970s marked a pivotal moment for the dollar. This shift allowed for greater flexibility in monetary policy, which has fueled the dollar’s rise as a trusted reserve currency amongst global economies.

However, as we examine the current challenges to this status, we must consider historical parallels and lessons learned. The fluctuations of past currencies suggest that dominance is often cyclical, and the rise or fall of a currency can be influenced significantly by external pressures, including global conflicts and domestic governance. Rogoff’s reflections on this historical precedent highlight that while the U.S. dollar currently reigns supreme, the economic landscape is always subject to change.

Effects of Geopolitical Events on Dollar Strength

Geopolitical events play a crucial role in influencing the strength of the U.S. dollar. For instance, recent economic sanctions levied against Russia demonstrated the direct connection between U.S. foreign policy and the global perception of dollar reliability. Rogoff argues that such events not only affect immediate trade relations but also send ripples through the global economy, prompting countries to reassess their reliance on the dollar amid rising tensions. Countries observing U.S. sanctions may be inclined to bolster their own currencies to mitigate risks.

In the face of international crises, the U.S. dollar has historically been viewed as a ‘safe haven’ currency. However, frequent usage of sanctions could foster resentment and motivate others to seek alternatives. As nations grow more adept at navigating economic pressures, Rogoff suggests that the perception of the dollar may shift, leading to decreased confidence and increased volatility for U.S. assets. Proactively addressing these geopolitical factors becomes critical for maintaining the dollar’s legitimacy and global standing.

Public Perception and Its Impact on Dollar Value

Public perception plays a significant role in the health of the U.S. dollar. As average Americans begin to recognize the implications of dollar dominance on their daily lives, the understanding of how financial decisions impact broader economic stability becomes vital. This awareness is necessary, especially during crises where consumer confidence can shift rapidly. Rogoff notes that if the public perceives a decline in dollar strength, it could trigger reactions that further destabilize its value, creating a vicious cycle that further erodes trust.

Furthermore, an informed public can be an asset for policymakers aiming to preserve the dollar’s supremacy. Engaging citizens with clear narratives about the importance of the dollar not only to U.S. economic health but also to global stability can foster a collective effort to maintain its status. In a climate where the dollar faces challenges, maintaining public trust becomes essential to ensure smooth transactions and financial operations across various sectors.

Frequently Asked Questions

What factors contribute to the decline of the U.S. dollar’s global currency status?

The decline of the U.S. dollar’s global currency status can be attributed to several factors, including increasing fiscal deficits, rising interest rates, and the threat of losing central bank independence. Additionally, external pressures, such as economic sanctions and the desire of countries like China to reduce reliance on the dollar, contribute to this trend.

How do economic sanctions impact U.S. dollar dominance?

Economic sanctions utilize the U.S. dollar’s widespread acceptance to isolate targeted nations financially. However, as countries observe the negative effects of sanctions, they seek alternatives to the dollar, potentially undermining its dominance in the future.

What does Kenneth Rogoff predict about the future of the U.S. dollar?

Kenneth Rogoff predicts that while the U.S. dollar will remain a leading currency, its unique status will diminish over time. He asserts that factors such as increasing competition from other currencies and the fiscal challenges faced by the U.S. will lead to a gradual decline in the dollar’s dominance.

How might the decline of the U.S. dollar affect the world economy?

The decline of the U.S. dollar could lead to increased interest rates and higher costs of borrowing for the U.S. government. This shift may result in economic instability, as other countries might also face disruptions in trade and investment dynamics that have, until now, relied heavily on the dollar.

What historical context supports the notion of a decline in U.S. dollar dominance?

Historically, periods of dollar dominance have often been challenged by emerging economies or currencies. Economic events such as the rise of the euro and the increasing prominence of the Chinese yuan illustrate that the U.S. dollar’s dominance can be disrupted by changing global economic landscapes.

What role does central bank independence play in maintaining U.S. dollar dominance?

Central bank independence is critical for maintaining U.S. dollar dominance because it ensures that monetary policy is not directly influenced by political pressures. If the Federal Reserve loses its independence, it may lead to poor economic decisions that could weaken the currency’s value and negatively affect its standing in global finance.

How does Kenneth Rogoff’s view of the U.S. dollar’s future address concerns from recent economic sanctions?

Rogoff highlights that while economic sanctions have historically bolstered the U.S. dollar’s role, they also provoke nations to seek alternatives. This dichotomy presents a challenge, as it may accelerate the decline of the dollar’s prominence if countries successfully diversify away from it.

In what ways do everyday Americans benefit from U.S. dollar dominance?

Everyday Americans benefit from U.S. dollar dominance through lower interest rates on loans and mortgages, as well as the ability of the government to borrow cheaply. This dominance allows for more stable economic conditions, especially during crises when the U.S. can easily access funding.

What implications could the end of U.S. dollar dominance have for international transactions?

The end of U.S. dollar dominance could lead to significant changes in international transactions, such as the rise of alternative currencies for trade, increased volatility in exchange rates, and potentially higher costs for international goods and services.

How does Kenneth Rogoff’s personal experience influence his analysis of the U.S. dollar’s status?

Rogoff’s personal experiences, including his travels during the Cold War and insights gained from international economic engagements, inform his nuanced understanding of the U.S. dollar’s historical rise and indicate why its current status is under threat.

| Key Points | Details |

|---|---|

| Decline of U.S. dollar | Economist Kenneth Rogoff argues that the U.S. dollar’s longstanding dominance in global finance is diminishing. |

| Historical context | Rogoff’s experiences give him a unique understanding of the dollar’s rise and fall, including economic conditions post-World War II. |

| Impact of Trade Policies | Recent sanctions and the Trump administration’s tariff policies have accelerated the dollar’s decline. |

| External challenges | Countries, especially in Asia, are seeking alternatives to reduce dependence on the dollar. |

| Effects on Americans | Dollar dominance keeps U.S. interest rates lower and allows for easier borrowing during crises. |

| Future predictions | Rogoff believes while the dollar remains a key currency, its unique status will erode over time. |

Summary

The decline of the U.S. dollar marks a significant shift in the global economic landscape. As Kenneth Rogoff outlines in his insightful exploration of decades of global finance, the dollar’s supremacy is increasingly under threat from both internal fiscal issues and external geopolitical pressures. While the dollar will continue to play a vital role in global finance, its decreasing dominance will have profound implications for everyday Americans, affecting everything from interest rates to the U.S.’s ability to borrow effectively. Understanding the evolving dynamics of the dollar’s status is essential for policymakers and citizens alike.