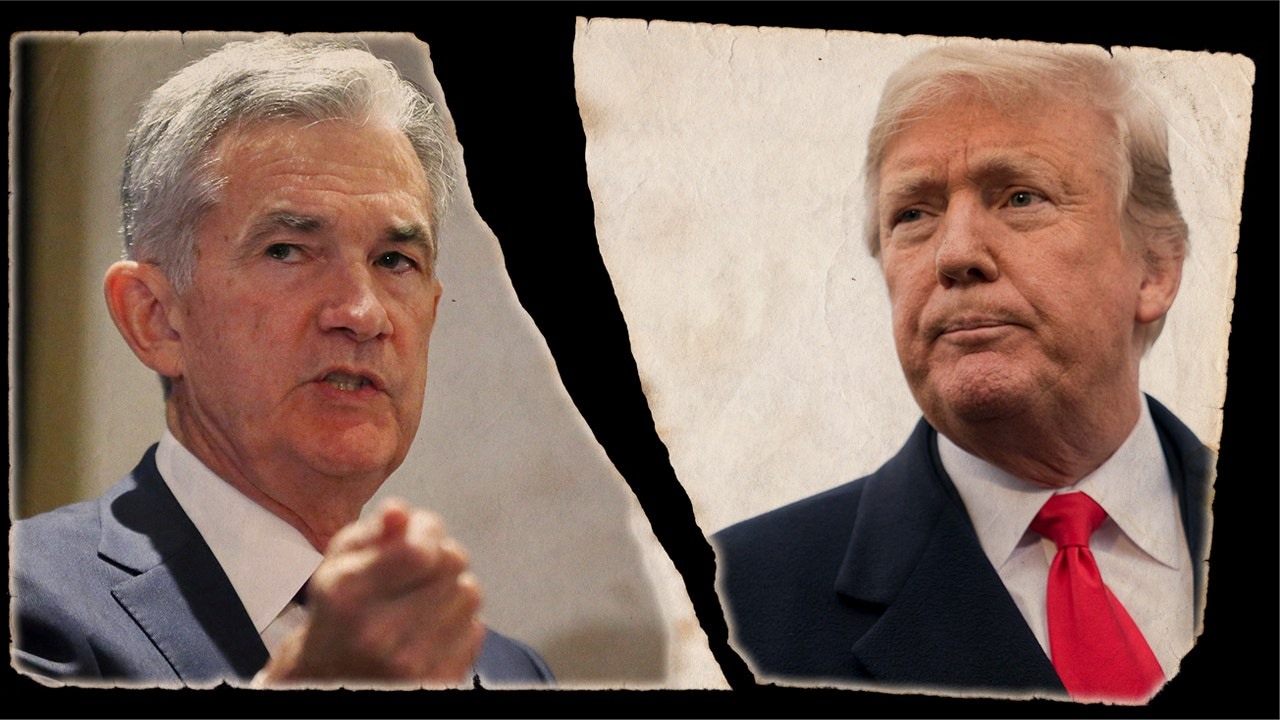

Can Trump fire Fed chairman Jerome Powell? This contentious question has stirred debate among economists and legal experts alike, especially in light of Trump’s tumultuous relationship with the Federal Reserve. As the current chair, Powell was appointed by Trump in 2017, and since then, their interactions have been laden with political tension and economic implications. Amid concerns over inflation and market stability, both figures have clashed over monetary policy, raising questions about the Trump Fed controversy. The market reaction to any potential firing of Powell could reverberate through financial systems, highlighting the delicate balance of political influence on the economy.

The topic of presidential authority over the Federal Reserve chairman brings to light significant constitutional and economic discussions. As debates arise about whether Trump could replace Jerome Powell, implications for monetary policy and market stability also emerge. The interaction between the executive branch and the Federal Reserve is an intriguing aspect of governance that reflects the delicate nature of economic independence. Various interpretations of the Federal Reserve Act suggest a complicated landscape regarding executive powers in relation to central banking. Analyzing the potential consequences of such a decision not only uncovers the intricacies of federal authority but also underscores the overarching impact on the U.S. economy.

Understanding Trump’s Authority Over Federal Reserve Leadership

The question of whether President Trump has the authority to fire Federal Reserve Chairman Jerome Powell is complex and rooted in legal interpretations of the Federal Reserve Act. This legislation permits the removal of governors for cause but does not clearly articulate the conditions under which the Fed chair can be ousted. This ambiguity raises significant discussions regarding the presidential executive power’s limits, especially concerning independent agencies like the Federal Reserve, which historically maintains a certain autonomy from political influence. Given the historical context and legal frameworks, this situation highlights important considerations regarding Trump’s relationship with Powell and the administration’s actions surrounding monetary policy.

Ultimately, as President, Trump possesses considerable power but firing a Fed chairman like Powell could be politically risky. Analysts argue such a drastic move could unsettle financial markets, as seen in previous remarks from Trump that sent waves through Wall Street. The financial and economic implications might deter any administration from pursuing such courses of action, making this a crucial point of contention in discussions about the independence of the Federal Reserve and its leadership.

The Impact of Jerome Powell’s Policies on the Economy

Since taking office, Jerome Powell has navigated a challenging economic landscape characterized by fluctuating inflation rates and political pressure from the Trump administration. Markets closely monitor Powell’s actions and policy announcements, which hold significant sway over economic stability. For instance, Powell’s decisions related to interest rates have not only impacted consumer confidence but also significantly influenced employment rates and inflation controls. There is a delicate balance that Powell must maintain to keep the economy healthy while responding to political pressures — particularly from Trump, who has advocated for rate cuts to stimulate growth.

Critics of Powell argue that his cautious approach may not match the aggressive fiscal policy many believe is necessary to drive economic recovery. In contrast, supporters point to the stability provided under his leadership as vital for maintaining long-term economic health against the backdrop of a politically charged environment. This highlights how Powell’s challenges are not just about economic data, but also about navigating the turbulent waters of political influence in American monetary policy.

Market Reactions to Political Interference in the Federal Reserve

Any discussion around the potential removal of a sitting Fed chairman creates ripples in financial markets, primarily stemming from the perception that political motivations may override objective economic policy. The market reaction to Trump’s threats towards Powell was evident, as investors grew increasingly anxious about the implications this could have on monetary policy independence and economic stability. Such political interference may breed uncertainty among investors, leading to volatile market fluctuations — a scenario economists argue could have harmful long-term effects.

Investors traditionally favor certainty and consistency in monetary policy, so Trump’s confrontational stance towards the Fed could undermine this trust. For instance, the market’s initial response to Trump’s comments about Powell was to react negatively, highlighting fears that any shifts in the Fed’s leadership would disrupt preconceived notions of policy direction. Therefore, it’s essential to recognize the interaction between political discourse and economic markets and how pivotal figures within the Federal Reserve — such as Powell — navigate these dynamics.

The Legal Challenges Surrounding Fed Chairman Removal

The legal grounds for President Trump to remove Federal Reserve Chairman Jerome Powell rest on interpretations of the Federal Reserve Act, particularly concerning the ‘for cause’ clause. Some experts argue the act offers protections to the chair similar to those afforded to other governors, suggesting a standard that requires justifiable reasons for removal. Others propose an alternative viewpoint, indicating that since Powell’s position includes a Senate-confirmed term, his removal could follow different legal contingencies than those of board members.

Understanding these legal frameworks is crucial to discern the potential ramifications of a presidential attempt to reconfigure the helm of the Federal Reserve. Many analysts suggest that such a politically charged action could lead to judicial challenges, further complicating the legality surrounding such firings. The legislative intent behind these protections implies that safeguarding the Fed’s autonomy is vital for maintaining economic stability, which resonates deeply with market participants and policymakers alike.

Political Influence on Federal Reserve Independence

The independence of the Federal Reserve is a cornerstone principle designed to insulate monetary policy from immediate political pressures. This principle is particularly relevant in periods of heightened political engagement, such as during Trump’s presidency when his vocal discontent over Powell’s policies sparked debates about the Fed’s operational autonomy. Understanding the challenges posed by political influence on the Fed is crucial, given that such pressures can potentially skew decisions against the backdrop of what is economically prudent.

Analysts frequently remind us that maintaining a non-partisan stance on monetary policies fosters long-term economic growth and stability. Any attempts by political figures, including President Trump, to intervene in Federal Reserve leadership could have wide-ranging implications. It could lead to a perceived loss of credibility for the Fed as an institution, enabling a shift toward naturally looser monetary policies that may not align with the long-term inflation targets set by the Fed, thus creating risk for economic health.

Potential Consequences of Powell’s Removal on Financial Markets

The prospect of Jerome Powell’s removal evokes concern among financial analysts and investors alike, as the act could lead to unpredictable consequences for the markets. Investors typically respond negatively to instability, particularly when it signals potential shifts in monetary policy direction. Should Trump succeed in ousting Powell, the ensuing uncertainty could lead to increased volatility in interest rates, affecting everything from consumer loans to corporate financing options. This ripple effect underscores the critical nature of leadership stability at the Federal Reserve.

Furthermore, the implications of Powell’s removal would likely extend beyond immediate market reactions. Proponents of a stable Fed argue that disruptions in leadership could fundamentally undermine trust in the institution, resulting in long-term repercussions for key economic metrics such as inflation and growth expectations. The historical significance of the Fed’s independence in nurturing economic confidence cannot be underestimated, as seen in past instances where political outbursts against the Fed have created lasting ramifications.

The Role of the Federal Reserve Chairman in Monetary Policy

The Federal Reserve Chairman plays a pivotal role in shaping U.S. monetary policy and guiding the economy through turbulent times. This position demands a careful balancing act; the chair not only leads the FOMC but also serves as the public face of the Fed, communicating its policies and decisions to the public and the markets. Jerome Powell, in particular, has had to navigate complex challenges, from responding to immediate fiscal concerns to addressing long-term inflation targets amidst political pressures.

Additionally, the Chair’s ability to forge consensus among the various committee members significantly influences the Fed’s operations. Unlike prior chairs who may have wielded more unilateral power, Powell has demonstrated a collaborative approach to policy-making, emphasizing the importance of diverse opinions and analyses within the board. This facilitates a cohesive policy environment that acknowledges both economic data and external pressures, ensuring that decisions are made in the broader context of the American economy.

Expectations After Powell: What Would Change?

Should President Trump successfully replace Jerome Powell, expectations around monetary policy could shift sharply. Markets are likely to react swiftly to the news, anticipating future policy directions that align more closely with Trump’s vision for economic growth. If a successor were appointed who deviated significantly from Powell’s cautious monetary stance, market reactions could become volatile as investors reassess risks and potential changes in interest rates. Indeed, Wall Street analysts are poised to monitor these developments closely, given Powell’s established reputation for stability and caution in the face of economic uncertainty.

The transition to new leadership could also reframe discussions regarding the Fed’s priorities, possibly paving the way for more aggressive monetary interventions. This potential shift could impact inflation rates and economic growth; thus, stakeholders across financial markets would likely shift their strategies to account for perceived risks. Therefore, the significance of Powell’s successor may extend well beyond individual policy preferences; it will encapsulate broader concerns regarding the Federal Reserve’s independence and credibility in achieving its statutory objectives.

Long-term Implications of Federal Reserve Leadership Changes

The landscape of U.S. monetary policy can be dramatically altered by changes in Federal Reserve leadership, especially in a politically charged environment like that of Trump’s presidency. If a new chair were appointed, and particularly if that individual reflected a more political alignment with the administration, the neutrality of the Fed could be undermined. This shift could potentially skew monetary policy towards short-term economic gains at the expense of long-term financial stability, creating an environment where inflationary pressures may rise unexpectedly.

Additionally, such changes could erode the confidence in the Federal Reserve’s capabilities, fostering skepticism about its operational independence. Historically, when the Fed appears aligned with political motivations, the public and markets may respond with wariness, potentially leading to heightened volatility. Therefore, discussions surrounding the implications of leadership changes at the Fed should consider both immediate effects on markets and longer-term repercussions for economic policy and inflation.

Frequently Asked Questions

Can Trump fire Fed chairman Jerome Powell?

While President Trump has expressed dissatisfaction with Jerome Powell, the Federal Reserve chairman, he cannot simply fire him at will. The law states that Fed governors can only be removed for cause, which raises questions about his legal ability to dismiss Powell. Even if Trump were to attempt such an action, it could lead to significant market instability.

What impact would firing Jerome Powell have on the market?

Firing Jerome Powell could trigger a turbulent market reaction. Investors generally trust the Fed’s independence and fears of political influence over monetary policy could result in increased interest rates and volatility, undermining confidence in the Fed’s ability to control inflation.

Is there a legal basis for Trump to remove Powell from the Federal Reserve?

Legally, the Federal Reserve Act allows for the removal of governors only for cause. Whether this includes the chair role, held by Powell, remains debated. Recent Supreme Court rulings could influence the interpretation of presidential powers over independent agencies like the Fed.

How would markets respond to the potential removal of the Fed chairman?

Markets are likely to react negatively to the potential removal of Fed chairman Jerome Powell. This reaction stems from concerns that replacing Powell may lead to a more accommodative monetary policy, increasing inflation fears and resulting in higher long-term interest rates.

What are the implications of Trump’s criticism of the Federal Reserve and Powell’s policies?

Trump’s ongoing criticism of the Federal Reserve and Jerome Powell’s policies indicates a push for looser monetary conditions to stimulate the economy. However, this could compromise the Fed’s independence, affecting monetary policy credibility and potentially leading to long-term economic consequences.

Can the Supreme Court’s decisions affect Trump’s ability to fire Powell?

Yes, the Supreme Court’s interpretations of executive authority and ‘for cause’ protections can significantly affect Trump’s ability to fire Jerome Powell. Recent cases suggest a potential shift in the understanding of removal powers concerning independent agencies, which could impact future actions.

Why do analysts warn against Trump’s desire to fire the Fed chairman?

Analysts caution against Trump’s desire to fire the Fed chairman due to the potential damage to the Fed’s independence, which is crucial for maintaining stable economic conditions. Any move to remove Powell could undermine market trust in the Fed and exacerbate economic uncertainties.

What is Trump’s history with Jerome Powell and the Federal Reserve?

Trump has had a contentious relationship with Jerome Powell since nominating him in 2017. He has criticized Powell for not cutting interest rates aggressively enough and has hinted at possibly firing him, which has raised concerns about the independence of the Federal Reserve.

What would be the long-term effects of firing the Fed chairman?

Firing the Fed chairman could have long-term effects like increased market volatility, loss of credibility for the Federal Reserve, and a shift in monetary policy towards more politically influenced decisions, potentially leading to higher inflation and economic instability.

How does political influence impact the Federal Reserve’s decisions under Chairman Powell?

Political influence can impact the Federal Reserve’s decisions by affecting how policies are perceived by markets and the public. If the Fed chair acts in alignment with political pressures, it risks losing its independence, which is essential for effectively managing inflation and economic stability.

| Key Point | Details |

|---|---|

| Trump’s Relationship with Powell | Trump and Fed Chair Jerome Powell have had a contentious relationship, with Trump criticizing Powell for not lowering interest rates aggressively enough. |

| Legal Basis for Removal | The Federal Reserve Act allows governors to be removed for cause, but it’s unclear if this applies to the FOMC chair. |

| Supreme Court’s Role | The Supreme Court’s interpretation of the president’s removal power over independent agencies could impact Powell’s position. |

| Market Reaction | If Trump were to attempt to fire Powell, market reactions could be severe, impacting long-term interest rates and economic stability. |

| Support for Independence | The fear of undermining the Fed’s independence often leads administrations to avoid firing Fed chairs, as market stability is crucial. |

| Chair’s Influence | While the chair is influential, decisions require consensus among the board and other members of the FOMC. |

| Potential Successor Impact | Markets may react negatively to Powell’s removal regardless of the successor’s credentials due to perceived policy changes. |

Summary

Can Trump fire Fed chairman? The answer is complex and involves various legal interpretations of the Federal Reserve Act and potential implications for the economy. While legally he may have the authority to attempt such an action, the potential backlash from financial markets and harm to the Federal Reserve’s independence and credibility makes it a risky move. In summary, any effort by Trump to remove Jerome Powell, despite the ongoing tensions, could trigger significant market turmoil, undermining the stability that the Federal Reserve aims to maintain.